Macro View of the Economic Environment

The anxiety among investors is understandable, given sky-high inflation, stock market losses, the war in the Ukraine, and looking mid-term elections. However, now is not the time to panic. One of my favorite quotes from Mark Twain is “History doesn’t repeat itself, but it often rhymes”. And what is happening today, certainly rhymes with what we have seen in the recent past.

Recessions (and expansions) are a normal part of the economic cycle. In good times, the economy is in expansion mode and the equity markets grind upward. When the economy cools off, companies cut back, we find ourselves in an economic recession and the equity markets pull back. What we are currently seeing the in the U.S. economy and the stock market is normal and should be expected to happen on a regular basis.

In general, the equity markets are one of many leading economic indicators for the overall economy. And, as of today, equity markets are signaling a recession in the next six to twelve months. Currently, all the major indices are in bear market territory (a decline of 20% from recent highs). In fact, the S&P 500 is now even with where it was in December 2020 – ONLY 18 months ago.

If the equity markets are correct, then the economy should be in a recession in early 2023. There have been 13 recessions since 1945, occurring about six years apart on average. Excluding the Great Depression, US recessions have lasted an average of about 10 months. The Great Recession (2009 Global Financial Crisis) lasted 10 months and it was followed by an expansion lasting more than 10 years. The pandemic-induces recession in 2020 last only two months and is the shortest on record. In fact, the Federal Reserve of Cleveland found that the worse a recession, the stronger the expansion that followed it.

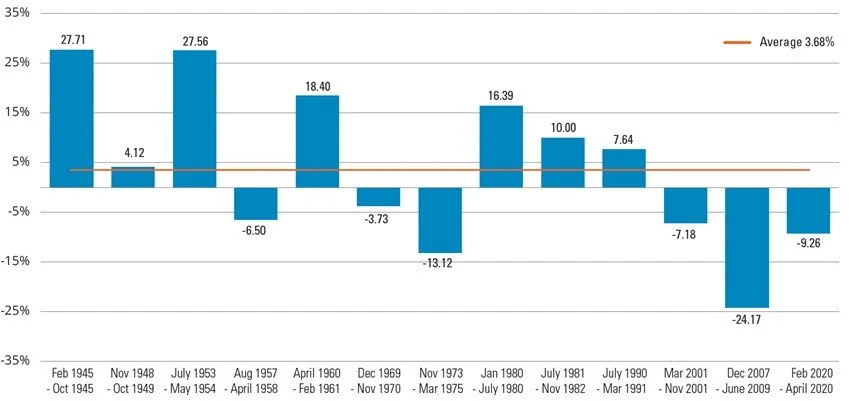

Returns in the equity markets have been pretty much evenly split between positive and negative returns. Figure 1 (below) shows the S&P 500’s index performance during recessions since 1945.

Figure 1.

However, if you look at the returns of the equity markets after the recession, you see that over the subsequent two-year period stocks outperformed their historical averages in most cases (see figure 2 below).

Figure 2.

Of note, the equity typically hit the bottom of the trough prior to the beginning. As you may note in the two figures, figure 1 shows the average return of the S&P 500 during the recession while figure 2 shows the returns of the S&P 500 from peak to trough before, during and after each recession.

Conclusion: Stay invested! There is no way of knowing how much the equity markets will correct, nor for how long. Equally true, our economy will find it’s footing, and the upward journey will begin, sooner than you might think.

Data source for recession statistics: NBER unless otherwise noted.